Startup of the Week – Cowrywise

| 3 minutes read

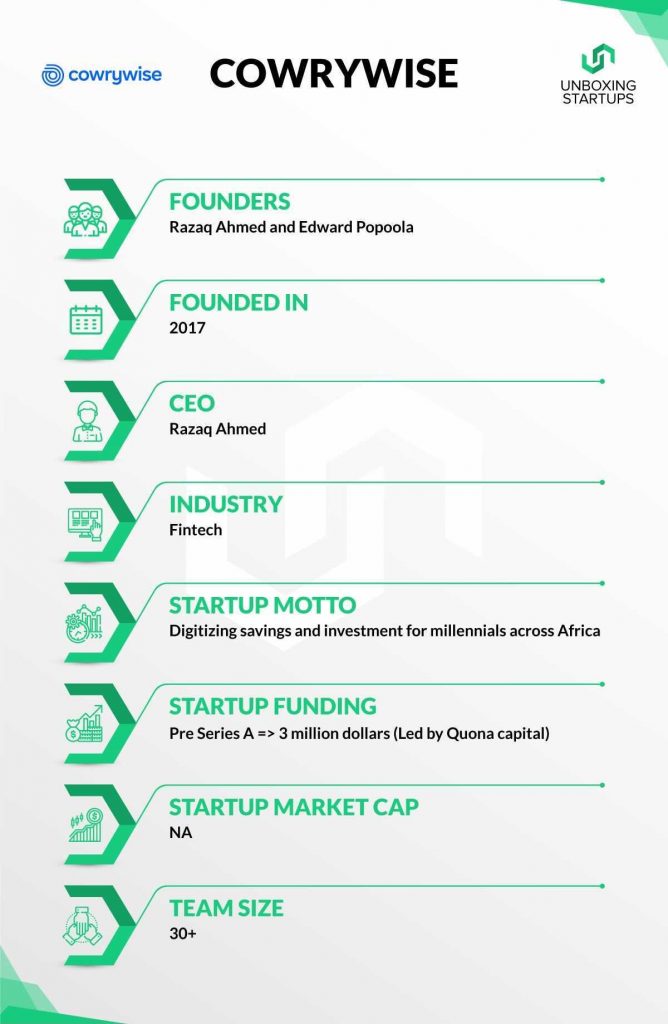

Founded in – 2017

Industry – Fintech

Founders – Razaq Ahmed and Edward Popoola

CEO – Razaq Ahmed

Startup Motto – Digitizing savings and investment for millennials across Africa

Startup Funding – Pre Series A => 3 million dollars (Led by Quona capital)

Startup Market Cap – NA

Team Size – 30+

Below is the transcript of our interview with Cowrywise

Could you please tell us about Cowrywise to our readers and entrepreneurs, what it is all about?

We are a wealth management company committed to digitizing savings and investment for underserved millennials in Nigeria and Africa. We provide easy-to-use, and accessible savings and investment products that empower everyday citizens to build wealth, one step at a time.

In Cowrywise, how do you encourage and help people to save money and invest?

In our clime, the first gap is limited financial education. This is why financial education is at the core of our product offerings.

We educate people about money habits through blog posts, videos, conversations, webinars, conferences, and every other platform and channel that reaches people. We also partner with burgeoning and established communities to reinforce the message of financial freedom through relatable content.

When it comes to investment, we want to know where are you investing your customer’s money and how the whole procedure work?

Saved funds are invested in low-risk instruments that guarantee security and safety while offering competitive interest rates. These include treasury bills and high-quality commercial papers.

We also have different Mutual Funds from outstanding fund managers in Nigeria available that customers can invest in at will. These include equity mutual funds and money market funds.

After the investment, what benefits are people getting? How do they get profit, like how much interest or how you calculate the investment profit?

Our savings products offer interest rates based on the overall interest rate in the market but are much more competitive than what traditional savings accounts offer. For mutual funds, the returns are determined by the changes in the unit prices of the funds over time. This is easily monitored in-app by our customers.

What are the challenges you faced during the initial days? And how did you push through?

A major challenge we faced was trust. Nigeria is quite sensitive when it comes to finance-centric discussions. Therefore, we had to ensure we were reliable, trustworthy, and were endorsed by the relevant authorities. This is why we pursued the goal of being licensed by the Security and Exchange Commission (SEC).

In Nigeria today, we are the first fintech with a fund manager license, which has further assured our customers.

What is your vision and mission behind this company? And where do you want to reach? Any future plans?

As said earlier, Cowrywise’s mission is to digitize investment management for Africans. We are committed to building innovative and scalable products that meet the savings and investment needs of the growing population of underserved African middle class and millennials. Today, we have over 300,000 thousand users, and the goal is to reach 10 million users by 2025.

What have you failed at? And how did you recover from that phase? Because being an entrepreneur is not easy, it’s like walking on a stone each day. So what boosts your mind when you face failure?

While we can’t point to any exact failure, a major setback we had was when there was a perceived security breach on a client’s account. But we scaled through, learned our lessons, and today we have earned the trust of both users and non-users of Cowrywise. Of course, each new day comes with diverse challenges, but we have surmounted them a step at a time.

In which cities you’re currently serving? Any further expansion plans?

Presently, Lagos. Nigeria’s commercial city, and yes, there are expansion plans; you would be aware as it happens.

Any secret formula to young entrepreneurs?

Have clarity about the kind of problems you are providing a solution to and give it your everything.

Could you describe yourself in one word?

Tenacious

Before we conclude the interview, anything you want to say to the Unboxing Startups team?

Well done, and kudos to the great work you are doing in spotlighting start-ups.

Born in the family of entrepreneurs and have inherited the same. Started building applications in order to pay for my tuition. Later founded a tech company, marketing agency, and media outlets.