How to Create an Effective Business Proposal for Investors?

| 6 minutes read

The business plan admits the entrepreneur to the investment process. Many investor groups won’t even grant or not even schedule an interview without a plan furnished in advance. And the plan must be outstanding and futuristic if it is to win investment funds.

But how do you write a good business plan for investors? Because if you have an excellent appealing business plan, only investors will invest in your business. Because no investor would like to support a loss-making or an industry with no proper business plan.

This guide will walk you through how to write a business plan for investors, help you answer the most critical questions about your business, and show you the best ways to illustrate them. We’ve also thrown in some additional resources you can turn to for help.

Besides, COVID-19 has changed the startup financing scenario significantly. The market leaders and trade pundits have assumed that the private market funding will fall to $77B in Q2 2020.

This significantly means that the financing industry is becoming very selective and competitive. But don’t put your brilliant idea on the shelf. A convincing investment proposal will give you an outstanding chance to source the funding you need.

A good business plan does more than inform investors about your company’s work. It persuades the investors, encouraging them to be involved.

Now the question arises, how do you write a good business plan for investors? It is entirely different from academic writing, but it is entirely new for you at the same time. It can be tough to figure out how to do something so technical if you’re a first-time founder. But don’t worry! Our guide will walk you through writing a business plan for investors, help you answer the most critical questions about your business, and show you the best possible ways to demonstrate them.

Whether you’re new to the business world or a seasoned veteran, you should develop an appropriate business proposal for investors to raise investment for your new business venture. Entrepreneur Magazine says, “Knowing how to write a funding proposal properly can either make or break your business idea before it starts.”

If you want to run your business for the longer term, you will require a brilliant business proposal to impress investors. We specifically created it to help you do just that.

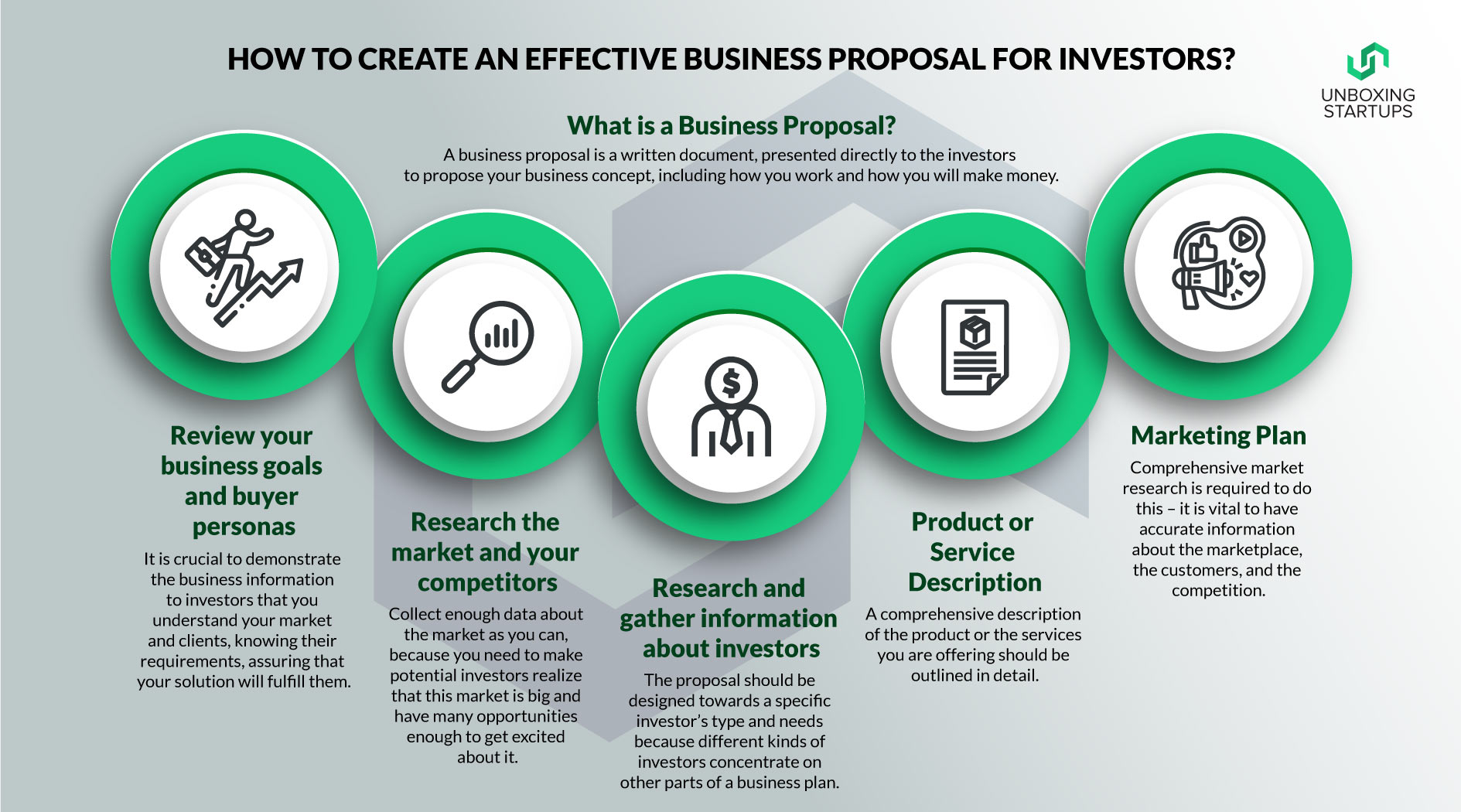

What is a Business Proposal?

A business proposal is a written document presented directly to the investors to propose your business concept, including how you work and how you will make money. It varies from a business plan in that it is used to “offer a product or service to a buyer or client” instead of a project that is “a formal statement of a set of business goals.” Instead, a business proposal will define the “problem statement and pricing information” related to your business and industry.

While briefing a business proposal to investors, the return on their investment will always be the investors’ foremost concern. “Excite” them with your pitch of how your company will get success and earn profit for you. Business experts believe that [making you] a proposal sounds like it can make money by creating a convincing proposition.

How to Create a Business Proposal?

Just as your business needs a plan, you must plan before crafting your actual business proposal. Draft an outline, make spreadsheets, and study other business proposals. As stated by Forbes, “You must spend a significant amount of time drafting a coherent and persuasive executive summary or business plan.”

Copying other proposals will create new opportunities for investors. Entrepreneurship professor Hakan Ener, who writes for Forbes, said, “Remember that resource providers evaluate your specific action plan, not a general business idea.” It also means that the investors you choose to present should be relevant to your business.

Below are a Few Essential Tips to Get Started.

Review your business goals and buyer personas

It is crucial to demonstrate the business information to investors that you understand your market and clients, know their needs & requirements, assuring that your solution will fulfill them.

Research the market and your competitors

Collect enough data about the market because you need Investors to Invest in Your Startup and make them realize how big the market and opportunities your business has. Alongside information on the market size & potential, your ideal buyer’s picture, and your product or service’s ability to satisfy your customers, you also have to notify your investors about how you will restrict your competitors from taking away your clients.

Research and gather information about investors

Ideally, the proposal should be designed toward a specific investor’s type and needs because different investors concentrate on other parts of a business plan. For example, bankers emphasize the proposal’s financial aspects and pay less attention to the market. And angel investors stretch both market and finance issues.

Product or Service Description

A comprehensive description of the product or your services should be outlined. Highlight those features that make the product stand above those currently being offered. Your centric focus should be on the benefits to the customer, the community, and the investor. Avoid using jargon but talk about your company’s expertise that your company can bring.

This is where you talk about how much it costs you to make the product and what you will sell it to wholesalers—including their markup potential—or directly to the end-user. Also, inform how you will deliver your products and how they will be delivered to the consumer.

Marketing Plan

One of the most critical sections of your business plan is your marketing plan. This section will ensure you have a sustainable competitive advantage against your investors. It assures them why you will succeed and how they will succeed where others have failed. Comprehensive market research is required to do this – it is vital to have accurate information about the marketplace, the customers, and the competition.

This section is where you add a final description of the Customers (your target market).

Market size – It estimates and unlocks the size of the potential market in terms of the number of people or businesses involved in your product or service.

Demographics – Your appropriate target market demographics, including age range, sex, religion, income levels, employment status, education, etc.

Growth prospects – Is the market already drenched? What is the growth potential of your product or services you offer?

Who are your Potential Investors?

Think about who your investors are and how their experience and expertise have made them superior in their business.

In a few cases, your potential investors might have substantial experience working in your target niche, in which case your business plan can be pretty detailed and technical.

If you are reaching out to investors who have investments across a broad range of different industries, be aware that they might not have the same level of technical knowledge that you have. Therefore, writing your business plan in relatively simple words can be better, avoiding jargon and acronyms not shared outside of your sector.

Alternatively, you want a versatile document for backers with different levels of specialist knowledge. For example, you could define technical terms in the text, footnotes, or glossary on the final page.

In any situation, it is better to make sure your business plan will be understood by as many people as possible when they read it; of course, you’re improbable to offend technical readers by defining specialist terms. Still, you avoid excluding the more general investors simultaneously.

Beyond your Business Plan

If you use your business plan to raise seed funding or other early-stage finance, consider what will happen during the longer term.

A four-year business plan might still not see your company reach full maturity, and if you need funds to expand further, you’re likely to look to a Series A or Series B finance stage to help with this.

Make sure you consider this in your business plan. In addition, any investors who take an equity stake in your company will want to know if you will give more equity away in later fundraising stages.

By being honest with them from the outset, you can assure all parties, what to expect, and you might find this helps you attract a higher ability of investors as a result.

Operational team Logistics

Information that can help potential investors form a favorable opinion of your startup and its potential is your current team’s structure — the one that will achieve your goals. This includes your business location, the number of employees you have hired/ plan to hire, the equipment or technology you need to get the project up and running, and any applicable operational expenses.

Project Financing

Seeing how this is the proposal’s entire goal, make sure you use accurate numbers and include lots of detail. For example, this part should stipulate the funding sources, forecasts, timeframes, ROI, and the investment exit plan.

An exit strategy is a crucial point in an investment proposal that’s necessary for two situations:

1- When a business has met prearranged investment criteria or when a company has failed to achieve its distinct profit objective.

2- Usually, it’s an eventuality plan with information on what to do to limit financial losses if the business goes under.

An Exit Plan for Investors

Finally, investors should know their options to exit your company as per the situation. However, the majority will be looking to make a good return on investment within a few years after the acquisition.

To get back their investment, your supporters need to be able to sell it. This means selling your company at a profit, launching an initial public offering (IPO) to individual shareholders, or buying back investors’ equity using earnings from your business.

If you disagree on how to proceed – for example, if a major investor in your business wants to sell the entire company but would like to buy back their equity stake – this step can stress your professional relationships.

To avoid this from happening, make sure you think or strategize about the exit strategy you set up for your business from the beginning.

When you’re writing your initial business plan, exits and sequence planning can feel like a long way away, making it even more critical to plan for those eventualities.

Recommended Post:

Why does a Company Needs to Build Healthy Business Relationships?

Want to Become a Millionaire? Follow Warren Buffett’s 4 Rules

Born in the family of entrepreneurs and have inherited the same. Started building applications in order to pay for my tuition. Later founded a tech company, marketing agency, and media outlets.