What are 3 Realistic Ways to Fund Your Startup?

| 5 minutes read

- Apple Inc. and technology giant Microsoft, investing $108 Billion in SoftBank’s Vision Fund, a conglomerate holding company headquartered in Tokyo, Japan- reported by Businessinsider.

- As per the Techcrunch report, Sony’s Japanese electronics manufacturer announces a $185M fund to invest in tech startups. It will help the company to innovate- a new path-breaking technology.

- Airbnb Inc. is a reputed American online marketplace company that offers various travel experiences, homestays, and lodging. As per BloombergQuint, an online business portal reported, Airbnb has funded $160 million for a small, luxury-rental apartment startup & overall an investment in business-travel startups.

Introduction

Whenever we talk about startups, the crunch of cash flow or the early closure comes to mind. But do you know multi-billionaire companies do startup funding? Do you know the reason why?

Startups are one of the best experimental platforms where there is a scope for the invention of technology at its best. Multinational companies believe it is best to face minimal risk with maximum output.

There are various ways to fund a startup business; you need to think systematically as per your business plan and goal.

What If a Business Owner Runs Out of Cash?

Many small business owners face a common issue in their entrepreneurial journey. Lack of cash flow is one of the primary reasons for small business failure. And it may be the leading cause of your business anguish.

Always stick to your existing plans, and rather than closing the business, hold the company for a specific time. Then, you can contact other business owners, talk to your family, arrange to crowdfund, and consider taking small business loans. ‘Do it yourself; if you’re a business owner, you have to follow the basic rule of doing it yourself.

Remember, there are several ways you can get the cash flow to turn your dreams of owning a business into reality.

How Many Funds Are Required Before Starting the Business?

According to the U.S. Small Business Administration, most small businesses would cost around $3,000, while most home-based franchises cost approximately $2,000 to $5,000. But every business has its own needs and demands. For example, an entrepreneur who created a technology startup company estimates that a business owner needs at least six months’ worth of fixed costs at the startup. So recognize your customers before you open the door to have a way to start covering those expenses’.

Gerber said when planning your business operation costs, don’t underrate the additional expenses, and remember they can rise as the business grows. It’s easy to overlook expenses when you’re thinking of reaching up to a certain height, but you should be more precise when planning your fixed expenses.

Should You Hire a Fresher or an Experience holder? To Save Business Costs.

If you hire a fresher, you might save costs, but a fresher cannot do the work that an experienced employee can do. On the other hand, people with experience can fulfill all your requirements regarding working quality. But there will not be any specific conclusion; it depends on the business requirements for the correct position in the startup.

The demands are different, and so is the need!

Should You Hire For All Positions?

In startups, there has always been a limited fund available. Therefore, it becomes crucial how you utilize the money for business growth. ‘Hiring people and Building a team’ look the same but are two different things. If you have a limited clients and work, hiring more people may increase the financial load. On the other side, if you have many clients and work, it is an excellent option to build and extend your team. This practice will help you to save time and also increase productivity. Therefore, choose the suitable option as per your business structure.

Building a startup is not an easy job; we should admire who starts a company. However, there have always been expectations and goals set for every company. Running a startup may be difficult, but in the next phase, it is also gratifying.

- Not sure where to start?

- Not sure whom to contact?

- Not sure how to get fund your startup?

There are multiple sources and platforms where you can get money to run your business.

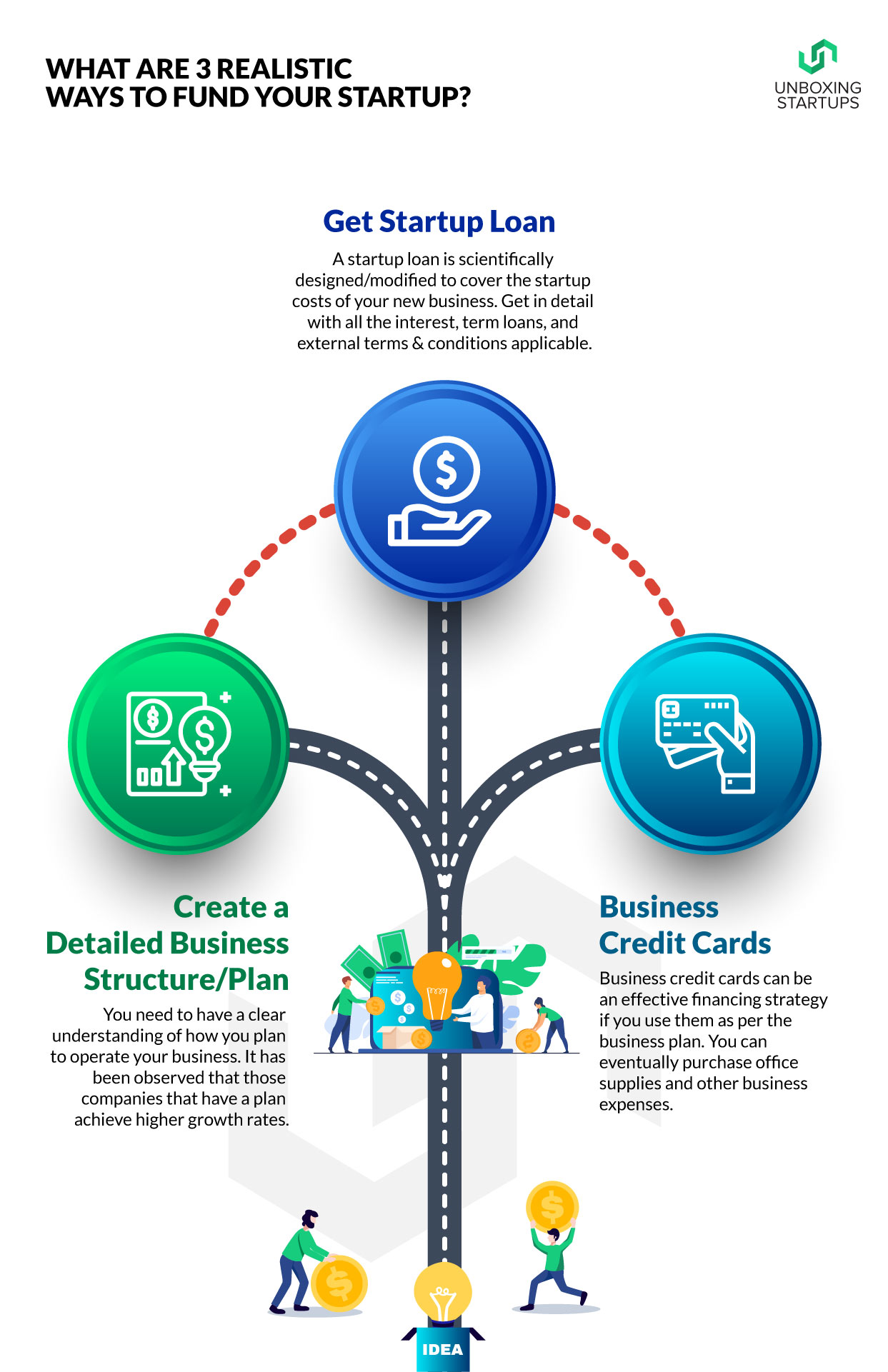

1. Create a Detailed Business Structure/Plan

Before getting into something, you need to understand how you plan to operate your business.

It has been observed that companies with a plan achieve higher growth rates.

Here’s why.

First of all, it is essential to raise money with a proper business plan. You can use a business plan template to get started.

Investors will see the company’s financial status before they even consider giving you a dime. But then, once you get into the chore of your day-to-day business operations, you’ll always have your plan as a reference to remind you how to proceed.

– Your business plan should have a clear description or reflect a precise detailing of your business.

- Who are you?

- What do you do?

– Make sure your projections are genuine.

It is impossible to turn a profit on your first day or even the first year in traditional business culture.

That’s okay.

Just try your best to forecast your finances precisely.

2. Get a Startup Loan

When you approach a bank for a loan, dress professionally, and introduce all your business plans to the loan officer. Get in detail with all the interest, term loans, and external terms & conditions applicable.

A short-term business loan is applicable mainly for running and starting a business. A startup loan is scientifically designed/modified to cover the startup costs of your new business. You can eventually use the funds towards expenses like supplies, working capital, furniture for the office, and equipment purchases for your company.

Startup loans use two excellent sources naming, Accion and the Small Business Administration.

Accion

Accion is a non-profit organization that gives people the financial help they need to improve their lives. And that includes small business startup loans! This is one of the few lenders that will provide you with funding before launching your endeavor.

Accion’s qualification, the requirements may vary depending on your current location. It would be best if you had no bankruptcies in the past year and no dues left.

SBA (Small Business Administration)

Typically, you need to be in business for 2+more years before qualifying for an SBA loan. The Small Business Administration offers two specific options for potential entrepreneurs: a microloan program and Community Advantage Loans. The SBA doesn’t make loans; they guarantee/assure them.

3. Business Credit Cards

Business credit cards can be an effective financing strategy if you use them as per the business plan. For example, you can eventually purchase office supplies and other business expenses. In the following way, you’ll keep your cash flow available for fees you can’t pay with a card.

The advantage of a business credit card is the fraud protection they offer. Your business credit cards will be blocked/suspended if someone uses your card without your consent.

You’ll need your consumer credit score to be 600 or above to qualify. Small business credit card issuers will also look and collect information on all of your sources of income to ensure you can pay your bills on time.

Conclusion.

Starting a new business is always exciting, but not everyone has enough capital to run their startup. If you can not fund your business, try getting a loan or ask your family or friends for help.

You must always start with a strong business plan with realistic financial projections. You also need to keep all your costs as low to make your funds last until you get a steady income stream.

Good luck!

Born in the family of entrepreneurs and have inherited the same. Started building applications in order to pay for my tuition. Later founded a tech company, marketing agency, and media outlets.