How to Design a Successful Revenue Model For Your Startup?

| 4 minutes read

One of the most crucial things you can do to ensure your business’s financial health is to design a revenue model. Today, we will discuss what you need to consider while creating an effective revenue model for your startup. If you follow these crucial steps, we are sure your final model will give you outstanding results.

Your revenue model gives you an overall understanding of your cash flow and needs and is your way of demonstrating to yourself and potential investors how you plan to price your products and services, earn revenue, and maximize your sales and profitability.

So, how do you go about creating an outstanding revenue model? First, you need to find out what revenues you can assume to generate. It doesn’t matter; if you’re still at the pre-revenue stage, you should build a financial model that includes your revenue estimates. Financial forecasting can be done in two ways: projecting your numbers from the top-down or building your projections from the bottom-up.

Top-down forecasting won’t generate realistic figures, but it is still important to show investors when raising money. Top-down forecasting starts with estimating the total market size and then gauging your target niche’s size within that market. Finally, count the share you will capture at a ballpark figure for your revenue potential.

The better approach is to make a bottom-up projection. To do this, decide which section will have the most significant impact on your revenue over the next year. Next, figure out how much you must spend to reach your revenue (already targeted) and development targets and your crucial revenue drivers. Finally, it will estimate how fast you can scale, incorporating staffing levels and upcoming milestones.

The revenue model is essential for a few reasons. Some of them are;

- It delivers the profit and loss statement (total revenue)

- It also provides gross revenue

- It allows us to understand marketing, personnel, and operating budgets

- It helps us determine the company’s valuation and the potential returns investors can expect on their investments.

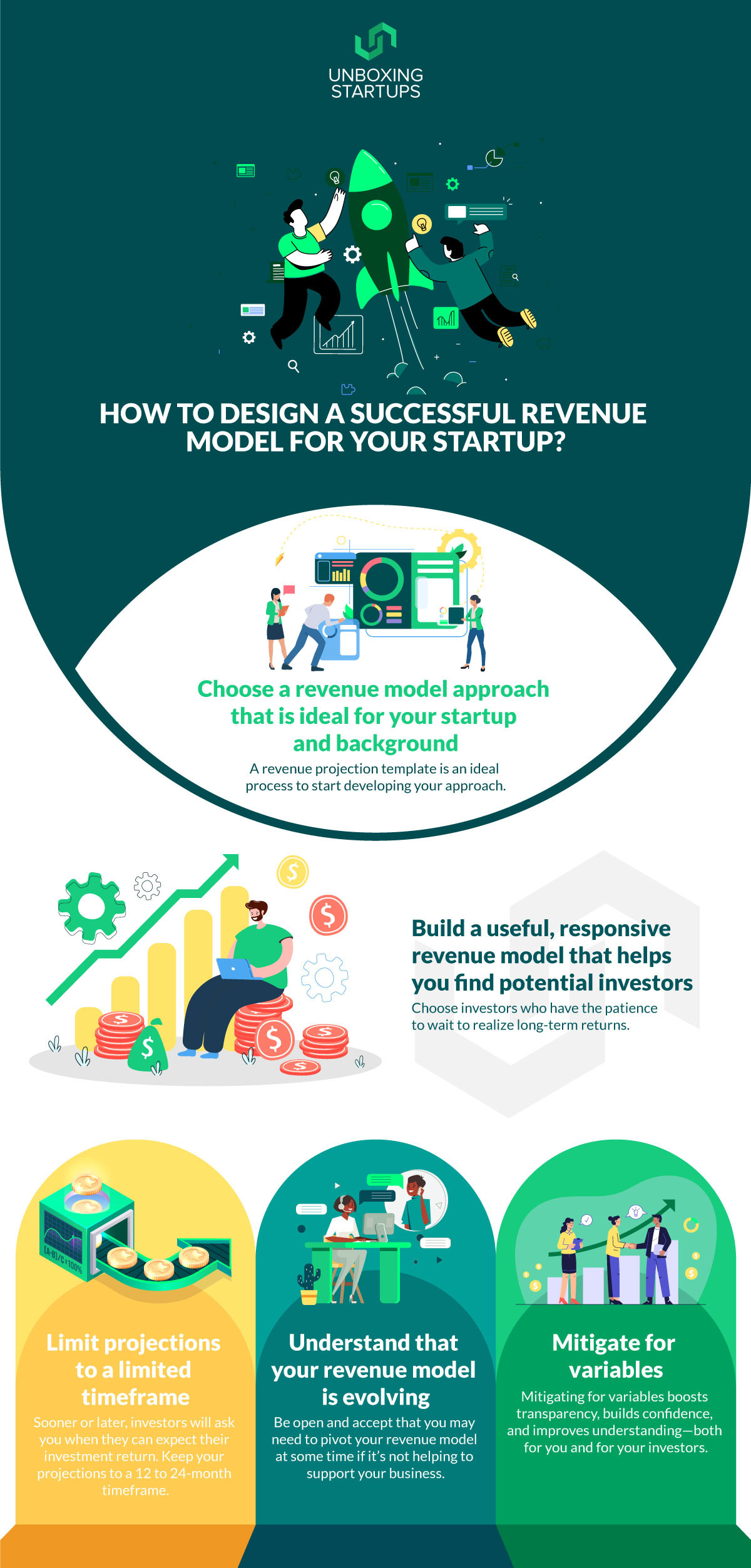

Many companies pass through the process of creating their revenue model. Here are the five key considerations for creating an effective model:

Choose a revenue model approach that is ideal for your startup and background

For this revenue model example, suppose you have a team of engineers with brilliant business sense. In this case, a technology model—where you classify, where you are currently in your R&D (Research and Development) model, and where you expect to be in the next phase —will be an ideal fit for your company. Depending on your company type, it makes sense to have linear revenue projections or exponential (in simple words, do you want to mitigate capital risk and start small and build from n there or prove your revenue model at scale?). Ultimately, you want to select a model that helps you direct your development steps. A revenue projection template is an ideal process to start developing your approach.

Build a useful, responsive revenue model that helps you find potential investors

You can modify your pitch by making development choices showcasing investors in which you are worth investing. Be strategic: focus your strategy on finding investors who will be an excellent cultural fit and be in it for a long time. Choose investors who have the patience to wait to realize long-term returns. Therefore, making an appealing model that can maximize and attract potential investors’ investment in your business becomes crucial.

Limit projections to a limited timeframe

Sooner or later, investors will ask you when they can expect their investment return. They will want to know what you have achieved till now. Investors will also want to know when you expect to become cash-flow positive. It’s tempting to target revenues many years out, but like trying to predict the weather, your predictions become unreliable if you go too far off. Keep your projections to a 12 to 24-month timeframe.

Understand that your revenue model is evolving

Your overall architecture approach may not change much over time, but you should continually refine your model and re-forecast it. There are many revenue models you can choose from. For example, if you’re a service-based business, you can still sell services individually or focus on an advertising subscription model. Be open and accept that you may need to pivot your revenue model at some time if it’s not helping to support your business.

Mitigate for variables

Risk management starts with recognizing and understanding your key risk factors so you can address them. Don’t try to hide things under the rug—investors will find your secrets anyway. Mitigating variables boost transparency, builds confidence, and improves understanding for you and your investors. There are various options you get when it comes to revenue models. But not choosing isn’t one of them. It’s a precondition for startup success.

Conclusion

With the above information, we hope you get an idea about how things need to be done while designing a successful revenue model. Therefore, before diving into the other development process, make sure the revenue model is effective and designed per your business requirements.

Recommended Posts:

What is Business Liability Insurance and How Does it Work?

Best POS Systems for Small Businesses (2022 Exclusive)

Born in the family of entrepreneurs and have inherited the same. Started building applications in order to pay for my tuition. Later founded a tech company, marketing agency, and media outlets.