Funding Rounds from Seed funding to various Series and How Does the IPO Work?

| 9 minutes read

Introduction

Seed Funding Stages including Series A, B, and C funding rounds generally occur to make the startup appealing for acquisition or to support a public offering. If you’re new to the world of startups and have no idea about raising funds, then you need to make yourself familiar with these different stages first.

You’ll get the startup funding rounds to –

- Pre-Seed Funding Round

- Seed Funding Round

- Series A

- Series B

- Series C

The majority of the startups need external funding; the external round allows investors with the business opportunity to invest money in an emerging company, in exchange for partial ownership of that company. When you hear about the information of Series A, B, and C funding rounds, these terms are referring to the process of raising a business through outside investment.

Below, we take an in-depth look at what these startup funding stages are, how they work, and what makes them different from the others. Many businesses take months or even years in search of potential investors. In contrast, others (particularly those with ideas seen as revolutionary with a proven track record of success) may bypass some rounds of funding and move through the process of building capital even faster.

Once you understand the difference between these rounds, it will be easier to analyze the startup and the investing world’s procedure. Series A, B, and C funding rounds are entirely the ambitious target in the process of turning an innovative idea into a revolutionary global company, ripe for an IPO.

How Funding Works

Before we explore how a round of funding works, it’s essential to identify the different participants. First, individuals expect to gain funding for their company. As the business grows, the company starts expecting to face funding rounds; the first steps for a company begin with a seed round and continue with A, B, and then C funding rounds.

Whereas on the other side, potential investors are those who wish to invest in businesses where they can expect a good return and profit.

For this reason, almost all investments made during one or the other stage of developmental funding are organized so that the individual investor or investing company holds partial ownership of the company. If the startup grows and earns a profit, the investor will be rewarded equally with the investment made.

Before the first stage of funding begins, analysts undertake the company’s total valuation—valuations derived from various factors, including management, proven track record, market size, and risk. One of the critical differences between funding rounds has to do with the estimation of the business, as well as its maturity level and growth prospects. As a result, these factors help to influence the investors who are likely to get involved and the reasons why the company may be pursuing new capital.

1. Pre-Seed Funding

The earliest stage of funding a new company comes so early in the process that it is not included in the rounds of funding at all.

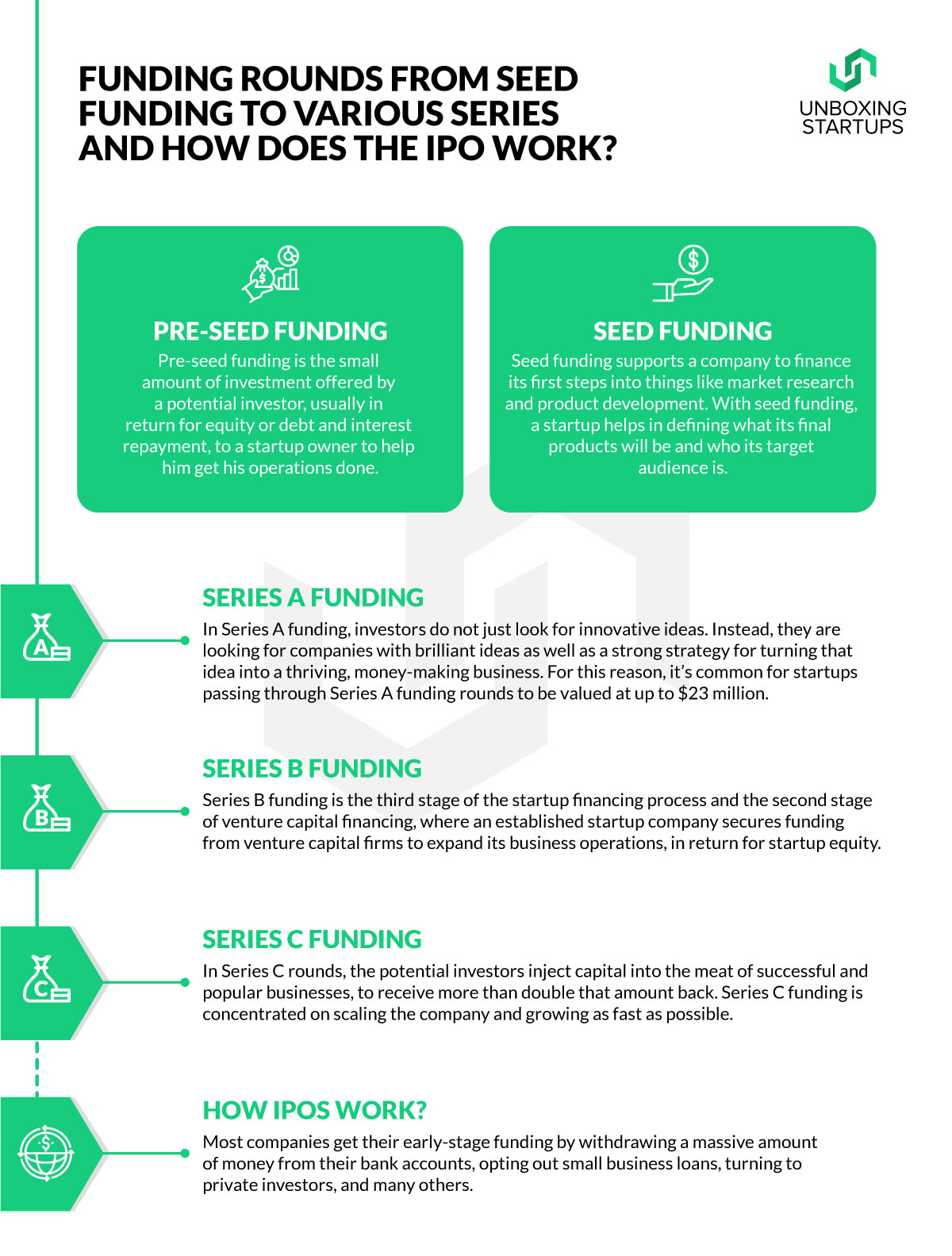

Pre-seed funding, also called pre-seed capital, is the small amount of investment offered by a potential investor, usually in return for equity or debt and interest repayment, to a startup owner to help him get his operations done.

In general terms, it is the investment required by the entrepreneur to

- Validate the problem-solution fit

- Get some real customer traction

- Develop the MVP and the actual offering

- Get key employees and partners on board

- Get the business started and begin operations

The most common pre-seed funders are the founders themselves, followed by close friends and family.

Depending upon the firm’s nature and the initial costs set up with developing the business idea, the funding stage may take a long time, or it may happen quickly.

There is a possibility that investors are not investing in exchange for equity in the company at this stage. It has been witnessed that, in most cases, the investors in pre-seed funding are the founders themselves.

2. Seed Funding

Seed funding, also called seed capital, is a significantly small amount of investment offered by an investor, usually in return for equity, to a startup owner to help him/her boost your business’s initial growth requirements.

It is considered to be the first official equity funding required by the startup founder to –

- Finance market research and product development

- Pay salaries and payments to all employees and partners

- Manufacturing products at large

- Penetrating an existing market or developing a new market for the product

- Building a brand

- Growing the team

Seed funding is the first and foremost official stage of equity funding. In simple words, it represents the first money that an enterprise raises. Few startup companies never go beyond seed funding into Series A rounds or beyond.

You can think of the “seed” funding as planting a new tree. The early financial support is ideally the “seed,” which will help to give a sudden initial boost to your business.

Seed funding supports a company to finance its first steps into things like market research and product development. With seed funding, a startup helps in defining what its final products will be and who its target audience is.

A seed funding round may significantly vary in terms of the amount of capital they generate for a new company. It’s common for these rounds to generate anywhere from $5,000 up to $3M for the startup in question. For a few companies, a seed funding round is all that the entrepreneurs feel is necessary to successfully get their company off the ground. These companies may never engage in a further funding round like Series A funding. Most companies raising seed funding are valued at approximately $2M and $6M.

Also Read: The Problem With the Funding is Not Lacking of it But Overfunding

3. Series A Funding

Once a business has developed a track record (an established user base, stable revenue figures, or some other crucial performance indicator), that company may opt for Series A funding to further optimize its user base and better product offerings. Opportunities may be taken to measure/scale the product across different markets. In this round, it’s essential to have a plan for developing a business model that will generate long-term profit. Often, seed startups have brilliant ideas that add a significant amount of passionate users, but the company doesn’t know how it will monetize the business. Generally, Series A rounds raise approximately $1M to $12M, but this number has increased on average due to high tech industry valuations. The average Series A funding of 2020 is approximately $15.6M.

In Series A funding, investors do not just look for innovative ideas. Instead, they are looking for companies with brilliant ideas as well as a strong strategy for turning that idea into a thriving, money-making business. For this reason, it’s common for startups passing through Series A funding rounds to be valued at up to $23 million.

The potential investors involved in the Series A round come from traditional venture capital firms. Reputed venture capital firms that participate in Series A funding include Sequoia Capital, Capital, Greylock, and Accel Partners.

Once a firm has secured a first investor, it may find that it becomes easier to attract more investors as well. Angel investors also invest at this stage, but they have less influence in this funding round than they invest in the seed funding stage.

It is becoming common for startups to use equity crowdfunding to raise capital as part of a Series A funding round. Part of the reason for this is the reality that many firms, even those which have successfully generated seed funding but fail to develop interest amongst investors as a part of Series A.

Indeed, fewer than half of seed-funded firms will go on to raise Series A funds as well.

4. Series B Funding

Series B rounds take your businesses to the next level, past the development stage. Series B funding is the third stage of the startup financing process and the second stage of venture capital financing, where an established startup company secures funding from venture capital firms to expand its business operations, in return for startup equity.

Series B funding is required to-

- Scale up the startup operations

- Hire top-performing employees

- Tackle growing competition

Investors help startups get, thereby expanding market reach. Companies that have to surpass through seed and Series a startup funding stages have already developed and created substantial user bases and have proven to investors that they are all prepared for success on a broader scale. Series B funding is generally used to grow the firm so that it can fulfill these levels of demand.

Building an outstanding product and developing a team requires quality talent acquisition. Bulking up on business development, sales, advertising, support, and employees costs a firm a few more pennies. It has been observed that the average estimated capital raised in a Series B round is $32M. Those companies who undergo a Series B funding round are developed and well-established, and their valuations say it all; most Series B companies have valuations between $30M and $60M, with an average of $58M.

Series B appears identical to Series A in terms of the processes and crucial players. The same players often lead series B as the previous round, including a critical anchor investor that supports to draw in other investors. The dissimilarity with Series B is the addition of a new wave of other venture capital firms that specialize in later-stage financing.

5. Series C Funding

Generally, this is the last private equity fund a startup raises. It is done to –

- Expand and step into new markets,

- Acquire new businesses, and

- Develop new offerings.

Businesses that make it to Series C funding sessions are already quite successful. These companies look for additional funding to help them develop new trendy products, expand their markets, or even opt to acquire other firms. In Series C rounds, the potential investors inject capital into the meat of successful and popular businesses, to receive more than double that amount back. Series C funding is concentrated on scaling the company and growing as fast as possible.

One best way to mount a company could be to acquire another company. Imagine a hypothetical startup focused on making vegetarian alternatives to meat products. If this company reaches a Series C funding round, it has likely already shown extraordinary triumph when it comes to selling its products in India. Well-planned market research and effective business planning help investors believe that the business would do well in other countries.

Perhaps this vegetarian startup has a competitor who currently owns a large share of the market. The culture appears to fit well as investors and entrepreneurs both believe the merger would be a long-lasting partnership. In this case, Series C funding could help to acquire another company.

When the whole operation gets less risky, more players come to invest. In Series C, groups such as investment banks, private equity firms, and extensive secondary market groups escort the type of investors mentioned above. The only reason for this is that the company has already proved itself to have a successful business model. A bunch of new investors comes to the table, expecting to invest the right amount of money into companies that are already flourishing as a means of helping to fix their position and status as business leaders.

Most importantly, a company will end its external equity funding with Series C. However, some companies can go on to Series D and even Series E rounds of funding. For the most part, though, companies making profits up to hundreds of millions of dollars in funding through Series C rounds are set to continue to develop globally. Many companies utilize Series C funding to boost their valuation in anticipation of an IPO. Companies fetching in Series C funding should have established, robust customer bases, revenue streams, and a record of proven histories of growth.

Companies who continue with Series D funding incline to either do so because they are in search of a final push before an IPO or because they have not yet been able to achieve the set goals they targeted to accomplish during the Series C funding process.

What is an IPO (Initial Public Offering)?

All startups have to start somewhere, and often, it involves having the entrepreneurs invest a portion of their own money to ultimately grow the business. But as small, private companies start to gain traction, many come to know that they need external investors to continue growing, and therefore decide to go public. And that’s where IPOs come in.

An IPO is a process by which a privately held company starts selling stock to external investors, thus becoming a public company. From that moment, the firm can raise the capital by selling shares, but it must also follow with a strict set of reporting guidelines, as established by the Securities and Exchange Commission (SEC).

How IPOs work?

Most companies get their early-stage funding by withdrawing a massive amount of money from their bank accounts, opting out small business loans, turning to private investors, and many others. A time comes when more money is needed for a business to experience the growth it desires.

Enter the IPO

An IPO is a process by which a company first offers shares of its stock to new external investors, thereby going public.

What further happens is that the company in question hires an investment bank to come in and underwrite the IPO for them. That bank will then put up a sum of money to fund the IPO and agree to buy the shares being offered before they’re listed on a public exchange. Now the question is, what’s in it for the bank?

Ideally, they earn profits in the form of paying less per share than what they end up selling for publicly.

To begin with an IPO, a registration statement must be filed with the SEC. That statement contains crucial details about the issuing company, including ownership and financial information. Once the SEC approves the IPO, a date for it is set. The underwriter (a person or company that underwrites an insurance risk) will then put forth a prospectus, the document that outlines the issues of a company’s finances. The underwriter also works with the issuing company to fix an initial stock price for when shares are made available to new investors.

The Bottom Line

Understanding the difference between these rounds of raising capital will help you decrypt startup news and estimate entrepreneurial prospects.

Startup profiles are different with every case study but generally possess other risk profiles and maturity levels at each funding stage. Nevertheless, seed investors and Series A, B, and C investors all help ideas come to completion. Series funding allows potential investors to support founders with appropriate funds to carry out their dreams, possibly cashing out together down the line in an IPO.

Founder of Cmile. Expert in mobile