An Exclusive Overview of C-Suite Executives Roles and Responsibilities

| 9 minutes read

Introduction

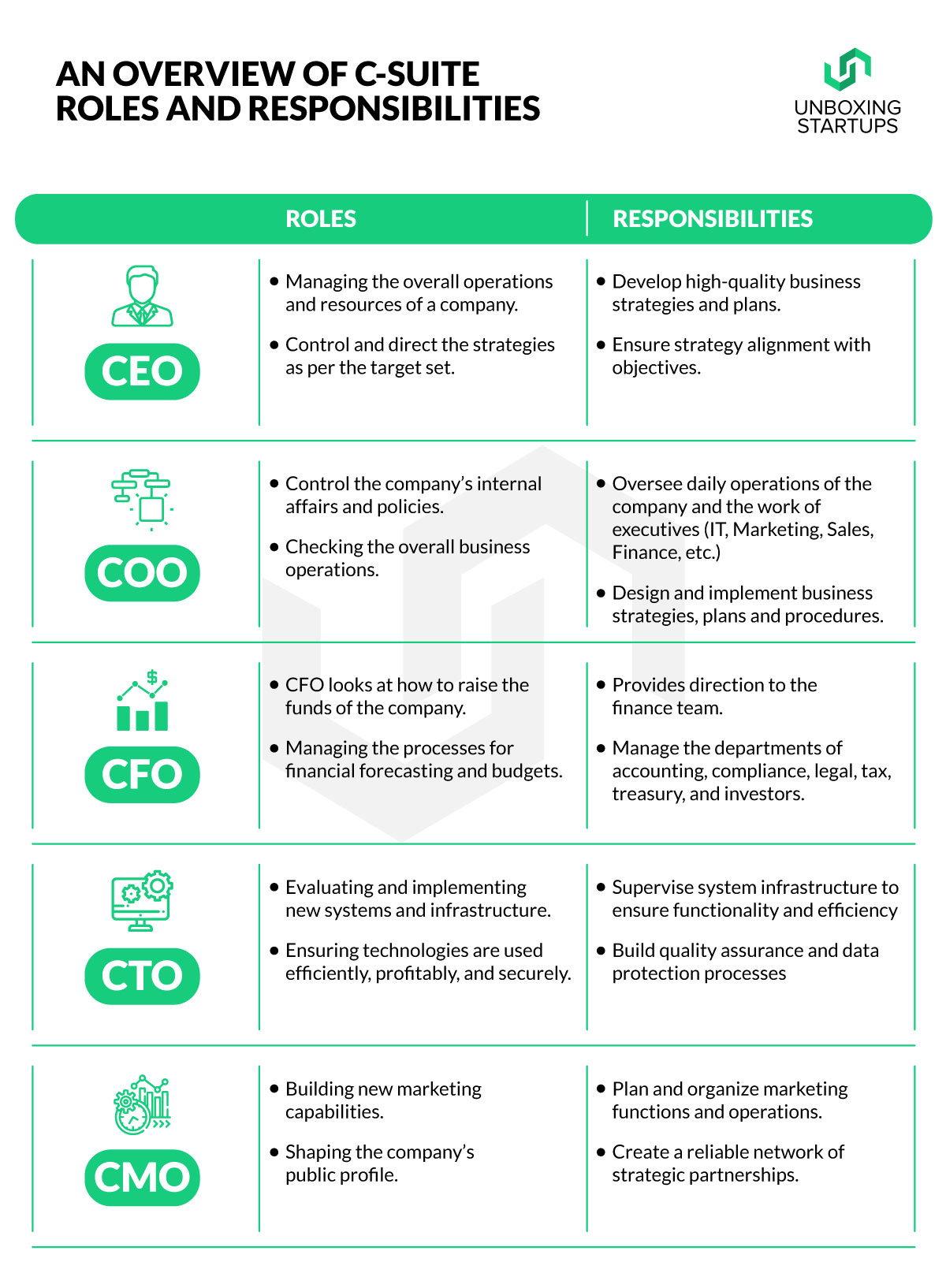

C-suite or C-suite executives refer to executive-level managers in a company. C-level is also called the C-suite executives, which include the Chief Executive Officer (CEO), Chief Financial Officer (CFO), Chief Operating Officer (COO), Chief Technology Officer (CTO), and Chief Marketing Officer (CMO) of a company. But while most of us dream so big, we sometimes forget that big dreams come with more significant responsibilities. It is not a cakewalk to be a part of top-level management, as it needs a lot of hard work and experience in the particular position. But once you acquire these, it is not difficult to reach there. You can also work with an executive assistant hiring company to increase your odds of getting selected for C Suite level positions. We will be discussing the crucial roles and responsibilities of the 5C’s (CEO, CFO, COO, CTO, and CMO) and who they are. Let’s find out. Kindly read till the end to understand the C-Suite Executives Roles and Responsibilities.

Key Takeaways

- The term “C-suite” or C-level refers to the executive-level managers within a company.

- Generally, C-suite executives include Chief Executive Officer (CEO), Chief Operating Officer (COO), Chief Financial Officer (CFO), Chief Technology Officer (CTO), and Chief Marketing Officer (CMO).

- C-level members work together and coordinate to ensure the smooth functioning of the company.

Who is the CEO?

CEO is a borrowed idea from the United States, first stated in Section 2(18) of the Companies Act, 2013.

CEO stands for Chief Executive Officer. They are the highest-ranked individual in a company. The CEO of a company is accountable for the overall success of a business and accelerates top-level managerial decisions.

The CEO is the company’s public figure and a link between the board of directors and operational managers. The board of directors elects a CEO to ensure smooth business operations.

Who is the COO?

Whereas the role of the COO is quite misunderstood because their responsibilities can vary greatly depending on the type of organization, what needs the organization is trying to meet, and other positions that exist within the business. For example, if a company has a CMO, the COO will be less likely to deal with marketing responsibilities. But, most importantly, the COO acts as a leader, ensuring that the organization and employees are forwarding the CEO’s vision.

Who is the CFO?

On the other side, the Chief Financial Officer of a company has significant responsibility, which includes planning, managing, and running all the company’s finance activities, along with business planning, budgeting, forecasting, and negotiations. In short, CFOs are fully responsible for the overall financial activities of a company.

Who is the CTO?

The chief technology officer (CTO) is the executive responsible for managing technology within an organization, including everything from creating a technology strategy to cybersecurity and product development. Technology officers need to understand broad technology trends and be able to align innovation with business goals.

Who is the CMO?

A CMO (chief marketing officer) is a C-level corporate executive responsible for activities in an organization that have to do with communicating and delivering offerings that are important for customers, clients, or business partners.

A CMO’s primary mission is to simplify growth and increase sales by developing a comprehensive marketing plan to promote brand identity and help the organization gain a competitive edge. To achieve their set target and effectively shape their companies’ public profile, CMOs must be exceptional leaders and assume the voice of the customer across the company.

Liabilities

CEO

A CEO is also liable for every offense, even crimes based on negligence, with regard to management. For example, if the balance sheet shows a misleading statement or if there is any omission, the CEO will be responsible. A CEO is also not permitted to show any interest in something which conflicts with the company’s interests. The CEO shares the performance report directly with and is accountable to the board of directors.

COO

COO stands for Chief Operating Officer. The COO is placed second in the chain of command (hierarchy for reporting relationships). In a few organizations, a COO is also known by terms such as “chief operations officer” or “operations director.”

The COO is the senior executive responsible for managing the day-to-day managerial and operational functions of a company.

The COO is appointed purposely to execute the business plans. The operating officer must help the company grow and ensure its financial strength effectively. They are the person who is responsible for the management of the departments of a company which is production, marketing, and sales.

There is a need for a COO because the CEO cannot invest his time in the business’s day-to-day operations. Therefore, there is a need for a COO. He will be responsible for the supervision and assuring the smooth functioning of the company’s day-to-day operations and, at the same time, reporting to the CEO.

CFO

CFO stands for “Chief Financial Officer.” The financial officer is the executive responsible for monitoring the cash flow and the overall financial activities of the organization.

The CFO is considered the same as an accountant or a controller and also checks the financial reports with accuracy.

The overall work of the CFO is to maintain and check the complete financial operations of the company. Also, they analyze a company’s financial strengths and weaknesses and give suggestions for its improvement.

CTO

CTO has responsibility for managing the physical and personnel technology infrastructure, including deployment, systems management, and the development of technical operations personnel.

A Chief Technology Officer’s job description could also include some practical aspects — if a tech team doesn’t have the knowledge or resources to complete a task, it is down to the CTO to find a solution. So it’s no wonder they have to obtain a wide variety of tech and ‘soft’ skills.

CMO

Chief marketing officers report to the CEO or chief operating officer (COO) and hold advanced degrees in business and marketing. A CMO with a strong background in information technology may also contain the chief marketing technologist (CMT) job title. However, in some larger organizations, those positions are separate, and the CMT reports to the CMO.

C-suite Roles and Responsibilities

CEO – Roles and Responsibilities

Roles

The CEO’s role is to design the strategies and policies for the organization, execute the plans, and direct the subordinates to accomplish the company’s goal.

The CEO’s role is also to organize, direct, and control the goals made and support strategic planning.

Responsibilities

- Planning, implementing, developing, and directing the organization’s operational and monetary function and performance towards the company’s vision and mission.

- Acts as a strategic partner by developing and implementing the plans and programs of a company.

- It makes necessary analyses and recommendations on a plan for a company’s long-term growth.

- Takes initiatives by introducing new strategies according to the needs of a company.

- Implements and enforces the policies and procedures of the organization that will enhance the operational and financial effectiveness of the company.

- Effectively communicates with the organization and with the Board of Directors.

- Provides guidance and advice to others about executing a plan or in a problematic situation.

- Continuously instruct the department by improving the planning and budgeting process.

- Evaluate the company’s financial, sales, and marketing structure to plan for continual improvements and increase operative efficiency.

- To encourage the company members, they daily interact with them and mentors them.

- Ensures that the company, wherever it does business, maintains a responsibility towards the social environment.

- They also analyze the risk and ensure that the necessary steps are taken to minimize it.

COO – Roles and Responsibilities

Roles

The responsibility of a COO might differ slightly from one organization to another. The COO controls the company’s internal affairs and policies. There is no detailed list that describes the job requirements for the position of COO. An Operating Officer may be hired to execute strategies/plans developed by the top-level authorities to oversee the organization’s ongoing business operation.

Responsibilities

The responsibilities of an operating officer are not precisely fixed; it varies from company to company and the nature of the work the company gives. A few of the day-to-day responsibilities are:-

- Analyzing the productiveness of business strategies.

- Establishing those policies where it helps to achieve the company’s vision and mission.

- Handling the issues of the staff and also supervising them.

- Developing and enacting the methods to meet the benchmarks and goals of a company.

- Ensuring the production and delivery of the products on time.

- Managing the working capital of the company.

- Ensuring inventory management of a company.

CFO – Roles and Responsibilities

Roles

- Raising funds- the CFO takes responsibility for growing the company’s funds. It is up to the CFO to assess the need and dig out the best possible way to raise funds.

- Understanding the capital market- as a lot of risks are involved. In contrast, the financial officer must evaluate and calculate the risk in trading in the capital or securities market. It all depends on the financial officer regarding the distribution of profits if earned.

- Profit planning- the primary objective is to earn a profit for any business. So the CFO must plan how to make a profit and look after the judicial mix of the variable and fixed factors that can contribute to the firm’s profitability.

- Should ensure that the funds raised are appropriately allocated.

- Financial control-proper evaluation of funds is required to control a company’s finance.

Responsibilities

- Provides direction, leadership, and management to the finance or accounting team of the company.

- Should develop financial and tax strategies.

- Whenever necessary, the CFO should arrange for debt and equity financing.

- Should participate in critical decisions which are related to finance as a member of the executive management team

- Manage the departments of accounting, compliance, legal, tax, treasury, and investors.

- Should look after the employee benefit plans with a particular emphasis on maximizing the cost-effective benefits packages.

- Should report the financial results to the Board of Directors.

- To look after the company’s business transaction processing systems.

- Should ensure that the record-keeping of the books of accounts meets the requirements of the auditors and government agencies.

- Identifies the financial risks and opportunities for the company.

- Provides strategic recommendations to the CEO and executive management team members related to finance or budgeting issues.

CTO – Roles and Responsibilities

Roles

- Developing the company’s strategy for using technological resources

- Ensuring technologies are used efficiently, profitably, and securely

- Evaluating and implementing new systems and infrastructure

Responsibilities

- Develop technical aspects of the company’s strategy to ensure alignment with its business goals

- Discover and implement new technologies that yield a competitive advantage

- Help departments use technology profitably

- Supervise system infrastructure to ensure functionality and efficiency

- Build quality assurance and data protection processes

- Monitor KPIs and IT budgets to assess technological performance

- Communicate technology strategy to partners and investors

CMO – Roles and Responsibilities

Roles

- Building new marketing capabilities

- Shaping the company’s public profile

- Changing to reflect new consumer buying behavior

Responsibilities

- Listen to the trends of the market and direct the market research efforts of the company.

- Communicate with other departments to guide a unified approach to customer service, distribution, etc. that meets market demands

- Define marketing strategies to support the company’s overall strategy and objectives

- Develop a feasible marketing plan for the department and oversee its day-to-day implementation

- Plan and organize marketing functions and operations (product development, branding, communications, etc.), and ensure they project the company’s unique “voice.”

- Design and coordinate promotional campaigns, PR, and other marketing efforts across channels (digital, press, etc.)

- Create a reliable network of strategic partnerships

Challenges

C-suite executives face a lot of challenges. Some of them are:

- Coping with market changes driven by unforeseen global events

- Creating new business models that meet evolving customer requirements

- Promoting corporate responsibility to help address issues such as climate change and equality

- Identifying their successors to ensure business continuity

- Ensuring compliance with changing tax codes and industry regulations

- Attracting and maintaining top talent, including enhancing the diversity of the workforce to include more women and minorities in leadership roles.

5C’s Pointers Differentiation

What is the difference between a CEO and a COO?

- The CEO is the one who makes policies and strategies for the company, and the COO is the one who helps to execute/fulfill these.

- The CEO is the one who exchanges talks with the stakeholders and investors. He makes all the crucial decisions related to the company. The COO looks after the day to day business operation of the business.

- In the chain of command, the CEO is considered the highest level, and the COO is after him.

What is the difference between a CEO and a CFO?

- Responsibilities may vary between the two as the CEO is responsible for all the organization’s activities, and the CFO is only accountable for the financial actions.

- The position of the CEO is managed by the Board of Directors, while the CFO has to report to the CEO.

- The CEO is responsible for making major corporate decisions and managing the overall operations, while the CFO only focuses on related financial issues.

- The CFO has a vital role as they have to make connections with investors, bankers, and lenders. The CEO is the front face of the company, but they do not make any such connection as the CFO makes.

- The CEO looks at and analyzes all the reports submitted by the financial officer to make necessary business decisions if required.

What is the difference between CFO and COO?

- The COO is the person who is responsible for accessing/operating the day-to-day business operations of the company. In contrast, the CFO is in charge of the company’s financial planning.

- CFO decides where and when to invest. He also minimizes the risk related to the company’s finance to maximize the organization’s value. The COO is the one who executes the strategic plans already set by the CEO of the company.

- In some industries, the COO is also known as the Executive Vice President of Operations, and the CFO is known as the financial director.

What is the difference between CTO and CMO?

- CTO assures the technologies are used efficiently in planning, whereas CMO develops marketing strategies that support the company’s overall strategy and objectives.

- The primary purpose of the CTO is to encourage and supervise the system infrastructure to ensure functionality & efficiency. In contrast, CMO implements marketing strategies for the department and checks day-to-day operations.

Conclusion

As discussed in the above information, choosing the correct C’s helps you accomplish your business goal; not only this, it also helps to monitor day-to-day business activities and operations. Also, CTO helps to utilize technology in planning and other business activities in the most efficient way. At the same time, an appropriate CFO will take care of all the company’s financial activities. Lastly, CMO takes care of the marketing angle of products and services. So overall, we mean to say that they (CFO, CEO, COO, CTO, and CMO) cover all the areas in business, and it will be worth adding 5C’s in your organization.

Planning + Executing + Financing + Marketing = Success and Growth

After combining their role in a business, this is how you get success.

Born in the family of entrepreneurs and have inherited the same. Started building applications in order to pay for my tuition. Later founded a tech company, marketing agency, and media outlets.